Is NPS a useful indicator of a target acquisition’s value?

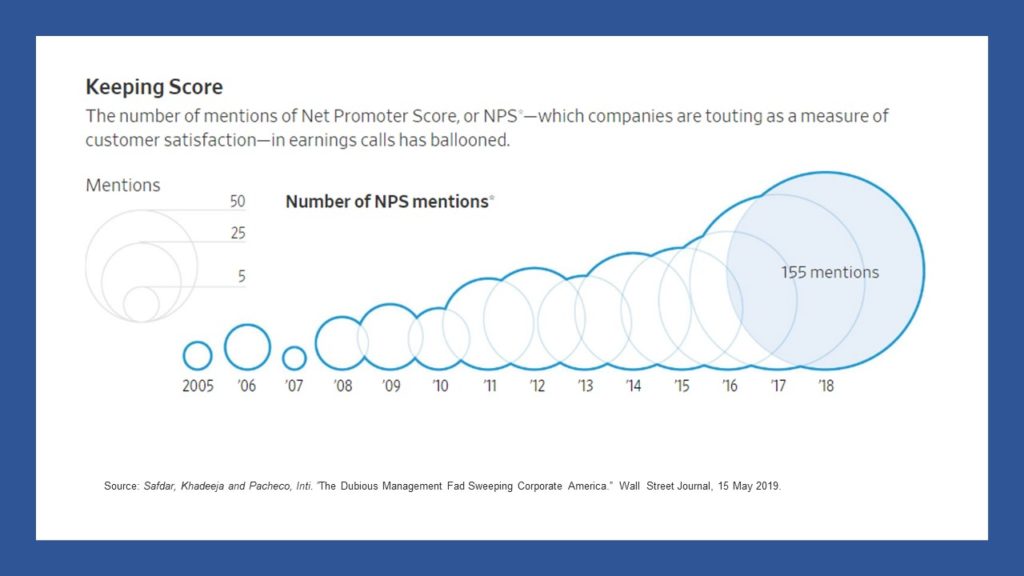

A recent Wall Street Journal article called attention to the “cultlike” following that NPS has garnered among CEOs in recent years. Their analysis found that in earnings calls by S&P 500 companies, “NPS” or “net promoter” were cited 150 times by 50 different companies. It was also mentioned in 56 proxy filings from 2018. The WSJ articles goes on to question whether companies have put too much emphasis on the one number system that is Net Promoter.

When evaluating an investment target, you’re likely to discover a trove of NPS results in due diligence. The adoption of NPS extends well beyond the S&P 500. Organizations of all sizes and across industries use NPS to measure the health of their customer base and improve customer experience, with the hope to ultimately increase revenue and profitability.

In light of the WSJ article and other criticisms of NPS, how much should you rely on it as a useful indicator of the target’s value?

Why did NPS become so popular?

While NPS has its detractors—pun intended—the system has important merits. Net Promoter grabbed attention as a metric that correlates directly to revenue growth and shareholder value.

NPS also gained popularity because it resolved problems with previous customer satisfaction measurements. Before NPS, companies relied on a collection of metrics to gauge satisfaction and loyalty. Because the collection of metrics was hard to communicate simply, they were often combined into a single number, such as a “Customer Satisfaction Index”. While the index provided one number, it was also hard to communicate and use. Managers had to unravel the index to the component level to understand shifts in customer perceptions and to identify improvements. Against this historical context, the simplicity of NPS is very appealing. One question is simpler. It feels more actionable because it is easy to understand.

5 recommendations to evaluate NPS data quality and validity

While NPS is used effectively by many organizations, the WSJ article makes a valid point that Net Promoter shouldn’t be adopted or used without critical analysis.

So, what does this mean for commercial due diligence? If your target acquisition provides NPS data, use these five recommendations to evaluate the data before you rely on it as a meaningful indicator of the customer health or business value.

#1 Representativeness

Who took the survey? A good place to start is to ask whether the NPS data are representative of the customer base, or skew toward specific customer segments/profiles. If so, consider how might that skew impact the NPS results. Data heavily skewed toward long-term customers can result in a higher NPS. Conversely, data skewed toward accounts in Japan can drag the NPS down due to cultural differences in how “likelihood to recommend” is interpreted across cultures. If skewed, weight the data to see how a more representative sample effects NPS.

#2 Sample size

How many customers provided data for the NPS? In addition to representation, take a look at the number of customers who provide data—the sample size. A criticism of NPS is that it is “noisey”. The Net Promoter is less stable than a traditional survey metric because it is derived by subtracting Detractors from Promoters. Smaller sample sizes exacerbate the extent to which NPS can fluctuate due to noise rather than real changes in the customer base.

#3 Trend over time

Is the trend over time erratic? In addition to the most current results, review the NPS trend over time. Due to the noisiness of the calculation, NPS can fluctuate over time simply due to small sample size. Changes in the composition of the data (mix of customers surveyed each wave) can also cause fluctuations. Examine the NPS in historical context. If it fluctuates from one year to the next, the current year’s score may reflect noise in the data rather than reality in the customer base. Conversely, a steady progression of improvement indicates a consistent measurement methodology and/or effective customer experience management.

#4 Relevance

How relevant is the NPS for the category? Is “likelihood to recommend” an appropriate question? Fifteen years ago, I worked with a major US online dating brand that had just launched in the UK. Very few Brits used online dating at the time, and some social stigma existed around the category. The client had just learned about Net Promoter and wanted to implement it. We found that even when consumers liked the brand a lot, they hesitated to “recommend it to a friend” because of the social stigma associated with online dating at the time. People were a little embarrassed to discuss it with friends, and therefore “unlikely” to recommend. One can imagine many consumer products where customers are reluctant to “recommend” a product or service. This effect is also relevant for B2B categories. For example, a bank may keep confidential the cybersecurity vendors it uses and therefore be unlikely to recommend when asked.

#5 Manipulation

Can employees manipulate the Net Promoter data, and are they incented to do so? Every car buyer has been counseled by their salesmen to give “only 10 and Yes” responses to the follow-up survey that determines a significant portion of compensation. The same behavior can occur when employee or executive compensation are tied to Net Promoter results. It is important to understand to what extent the target’s staff are incented to manipulate results. If a strong incentive exists, consider it a red flag to look at other metrics and gather objective/independent data.

If your analysis of the target’s existing NPS data raises questions, consider an independent assessment of the health of the customer base rather than relying on data provided by the target. Depending on your resources or timeline, options range from a set of targeted in-depth customer interviews or a more comprehensive survey to assess Net Promoter and other indicators of customer health and future revenue contribution.