How to identify the right price point in B2B markets

One of the questions in B2B go-to-market strategies is: What is the right price point for our offer? This post provides a high-level overview of standard pricing research techniques that can identify the market’s willingness to pay for your solution.

For most vendors, internal and secondary data set the foundation for pricing strategy. This includes building cost models and looking at competitor pricing. In some cases, these data are sufficient to inform price point decisions. In many cases, product marketers want feedback from the marketplace to avoid common pricing mistakes, such as: their pricing does not leave money on the table; priced too high for important buyer segment; or lead to significant competitive disadvantage.

Conducting pricing research provides insights to help product marketers further refine pricing strategies and find the right price point. Isurus recommends looking at pricing through three lenses: What the market pays today; a pricing exercise called the Gabor Granger method which explores willingness to pay, and a pricing analysis called the Van Westendorp pricing sensitivity meter which helps identify the optimal price point.

What the market pays today

What companies pay today for their existing solution provides an important reference point for understanding how much the market is willing to invest in solutions like yours. It reflects the relative importance of the job-to-be done in the solution category and indicates the market’s relative perception of the ROI of the solutions they use.

When B2B buyers evaluate new vendors/product, they use their current cost to anchor judgments about how affordable or expensive are the alternative solutions. The “right” price point is subjective. Knowing this starting point helps put your solution in context – will it be perceived a premium product, a good deal, in line with everyone else. It also helps inform other components of the go-to-market plan. For example, a product priced higher than the average current solution will need marketing and sales messages that show value for the extra investment.

In addition, in some B2B sectors competitor pricing is opaque. Price lists aren’t published, or list prices are negotiated in the sales process. Asking B2B buyers what they currently pay may be the only meaningful source of competitive pricing data available.

One important guideline to keep in mind: When asking B2B buyers what they pay, don’t apply an artificial level of precision to the data. B2B buyers are human and people often understate what they pay. They think about the main license costs but omit fees for enhancements and add-ons. Their data are accurate when treated as a scope-of-magnitude estimate, and you should then use judgement and inference to refine it from there.

The next step to identify the right price point is to collect direct feedback on your pricing. There are some advanced trade-off modeling techniques such as conjoint that can help refine costs. However, for most B2B offerings, two standard and straightforward pricing research methodologies provide the insights needed.

Willingness to Pay: Gabor Granger Method

The Gabor Granger method is a common approach to identifying the market’s price tolerance. In the simplest design the first step is to identify three price points for your solution/service: The lowest you can realistically price your offer at and still make a profit, the price-point you think is a realistic price, and a stretch price point, the most you feel you could charge for your offer.

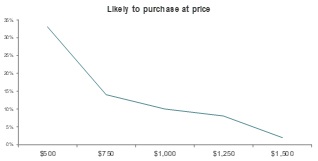

Once these three price points are selected, ask the market to rate its willingness to pay for an offer like yours at each price point, starting with your stretch price point. Those unlikely to purchase at your highest price point are presented your realistic price and again asked their willingness to pay. Those still unwilling to invest at that price point are asked about their willingness to pay at the lowest price point. Adding additional price points along the continuum (e.g., asking about four or five price points instead of three) helps identify nuances along the continuum.

The results are used to plot demand curves and calculate price elasticity.

The analysis provides two insights into the marketplace’s willingness to pay. The first is an estimate of the percent of the market that would be willing to invest at any given price point. The second is where pricing elasticity is flat – an increase or decrease in price has minimal influence on willingness to pay. In the example above, moving from $1,000 to $1,250 has minimal impact on the percent of the market willing to pay for the solution. The vendor would be leaving money on the table if they priced the solution at $1,000.

Optimal Price Point: Van Westendorp Price Sensitivity Meter

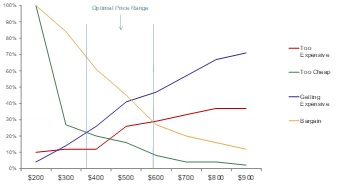

The second standard pricing methodology Isurus uses is the Van Westendorp Price Sensitivity Meter (PSM) which focuses on price expectations and acceptability rather than willingness to pay. In the context of a specific offer, the PSM explores the price point in four scenarios: When it is a bargain, getting expensive, so cheap it raises quality concerns, and prohibitively expensive.

The resulting data are plotted to calculate the optimal price range in terms of acceptance to the broadest percentage of the market. Prices above this price range will be acceptable to an increasingly narrow slice of prospects.

Isurus typically combines the Gabor Granger method and Van Westendorp in a study to mitigate the challenges associated with accurately measuring price elasticity. It is also important to note that both approaches assume that the audience is familiar enough with the products or product category to make reasonably informed judgements on the value of the solution and their company’s willingness to pay.

Insights and Use Cases

The data provided by types of questions will inform your pricing and go-to-market strategies by identifying:

- How your pricing compares to competitors and the market’s expectations

- Which market segments to avoid and which segments are most likely to find your pricing acceptable

- Potential ways to optimize your price point to gain market share or skim the market

- The sales and market challenge you face: Will you need to educate your buyers to help them justify the cost?

The framework outlined above can be explored qualitatively or quantitatively and managed internally or with the help of an external research firm. The Product Marketing Alliance also has some good recommendations for how to create an effective pricing strategy.

To learn more about how Isurus may be of assistance, you can contact us here.