Look beyond product for drivers of B2B satisfaction and value

Customer experience, by definition, incorporates all aspects of a company’s offering and cuts across organizational boundaries. Yet, B2B vendors continue to focus on the product as the main driver of customer satisfaction and value. Research by Isurus and other leading consultants shows how a more inclusive analysis of customer experience reveals more accurate and actionable results.

Follow the breadcrumbs

Take this example from a recent Isurus study. The product team at a manufacturer of industrial generators was shocked when it received lower than expected product quality scores on its voice-of-the-customer survey. The ratings didn’t fit with their understanding of their competitive differentiation. The company is generally considered a leader in its category, and objectively, its equipment is in the top tier of vendors. A commitment to delivering quality products impelled the team to act on the findings. But how?

Fortunately, in addition to exploring product attributes, the customer survey evaluated a broader set of company characteristics such as customer service, warranty, channel delivery, and installation. This data allowed Isurus to evaluate the full range of factors that influenced perceptions of product quality. The analysis revealed a key insight: when service techs returned after the initial installation to make adjustments to the equipment, the product quality score was lower. The customers assumed something was wrong with the product.

After a little more digging, the company found that two groups of contractors made more post-installation visits than average – newer contractor partners, and contractors with less commitment to the channel-partner relationship. With this knowledge, the company could tackle the right problem. The product didn’t need fixing; the company needed to reduce errors in the installation process. The company focused on improvements to training and customer support and increased engagement with its channel partner program and its contractor resources.

Beyond functional value

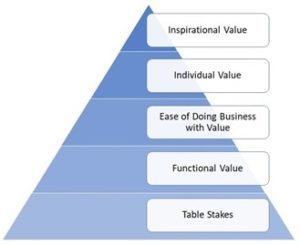

Bain & Company’s recent study of the Elements of B2B Value provides further evidence that non-product attributes drive satisfaction.

Source: Bain Insights – Elements of B2B Value

In this research, commercial insurance buyers rated 36 different elements of value ranging from threshold conditions such as cost, to aspirational elements such as helping the customer achieve its corporate vision. Cost and Availability received the highest ratings overall. Taken at face value this result suggests that insurance companies and brokers could differentiate by providing a wide set of low-cost policies. However, a regression analysis showed that Responsiveness and Knowing the Customer’s Business are the strongest drivers of loyalty – two elements steps away from the core product attributes. While Cost and Availability are the most important factors in their buying decisions, they are expected by the market and do not differentiate vendors – customers do not use vendors that they cannot afford or do not have the products they need. Isurus sees this dynamic so frequently in our research that we counsel clients to minimize the threshold factors they include in their customer surveys.

A framework to treat product myopia

It was only possible to uncover the insights outlined in the above examples because the customer surveys included a wide range of attributes related to the customer experience. Vendors and product teams live and breathe their solutions. They invest millions of dollars in the development, enhancement, and expansion of their offerings. When you’re this close to your solution, it’s easy to lose sight that factors outside of the product can be significant drivers of business value and satisfaction.

To mitigate this myopia, Isurus uses a framework of three categories of attributes: Capabilities, Company Traits, and Tactical Outcomes. We recommend that VOC programs incorporate attributes from across three categories.

- Capabilities: The features and qualifications most directly tied to the product such as features and functionality, quality, delivery, ease of use, cost, etc.

- Company Traits: The behaviors, values, and traits that relate to the higher-level value a company provides, which remain true even if the specific product/service offering changes. The type of attributes in this category includes responsiveness, partnership orientation, innovation, integrity, etc.

- Tactical Outcomes: The outcomes the customer expects the solution to accomplish – the job to be done. Examples include reducing the steps in a process, providing sales reps with real time information, reducing waste, etc.

The degree to which each of these categories are explored varies by market. For example, it’s more important for a commodity provider to understand the company traits that provide value – they cannot differentiate themselves on product. Conversely for vendors in an emerging technology market, it is important for them to understand the outcomes the customer is trying to achieve – additional features and functionality don’t make a difference if they don’t align with the customer’s business processes and goals.

The benefit of using a framework to guide the VOC program design is to ensure non-product attributes are measured and evaluated as potential drivers of customer satisfaction and value. A framework provides a reference and brings structure to the metrics selection process. Data that represents the full customer experience is much more likely to identify the true drivers of satisfaction and provide insights that lead to competitive advantage.