Map your competitive differentiation: What can you own?

Differentiating your product or brand boils down to two simple questions. 1) What are your customer’s needs and buying criteria? And 2) which of these can your product/brand own?

Most marketers and strategists do a good job on Step 1: They generally know their customer’s needs and buying criteria—the set of capabilities, brand traits, and outcomes that drive purchase decisions. This is the right first step. It identifies many key factors that influence vendor selection. But that initial list can be misleading and lack actionability. Here’s why.

- Competitors hold an advantage on some of the dimensions important to customers and it will be challenging and costly to compete on those criteria.

- Some of the customer’s most important buying criteria are threshold conditions and you cannot differentiate on table-stakes requirements.

Consider these examples.

- When selecting mission critical services, software, or products, many B2B buyers include vendor size and financial stability as two of their top buying criteria. A growth-stage start-up cannot compete on these dimensions against a large established provider. Conversely, the established vendor may struggle to differentiate on innovation. Only a few firms on the market can hold the position of “market-leading innovation”. Regardless of how important the dimension is to customers if your firm is not a leader in the category (financial stability or innovation) you cannot effectively use it from a positioning standpoint.

- Vendors that do not meet the critical table stakes thresholds are dropped from consideration. These dimensions are often binary – exceeding market requirements does not provide any differentiation. Consider data security in the evaluation of CRM solutions. It is a critical factor in a customer’s evaluation of vendors. But no one buys a CRM solution because it is the “most secure” system.

Both examples illustrate why it is critical to find criteria your product/brand does or can “own”. Without it, true differentiation and competitive advantage are not sustainable.

Mapping the Differentiated Positioning You Can Own

The following is a three-step process to map dimensions that will differentiate your brand and solution.

- Create a list of what your internal teams believe are the market’s key buying criteria

- Validate the criteria and measure your performance relative to competitors

- Build the map to identify your differentiation opportunities

1. Create the buying criteria list

Start by using your team’s expertise. Identify the set of solution and vendor attributes that customers look for when evaluating vendors. Cast a wide net internally and gather feedback from product marketing, product management, and sales teams.

The list should include three broad categories of criteria that are important in B2B buying decisions.

- Capabilities: These are the features and specifications of the product/service. Examples include specific functionality, delivery, breadth of product/service offerings, etc.

- Brand Attributes: These are the characteristics associated with the vendor providing the product. Examples include innovation, trustworthiness, partnership oriented.

- Outcomes: These are the job-to-be done by using a vendor’s product or service. Examples include controlling costs/waste, improved time to market, etc.

The list may become unwieldy. Be judicious and cull it down to the attributes most important to customers in the evaluation and purchase process. Eliminate table stakes criteria that you do not need to validate. And if you know your competitors well, there may be dimensions that you have no chance of owning in the near term. The goal is to define criteria that offer the best possibility to differentiate.

2. Validate and measure performance

Next, collect data from the target market to validate the buying criteria on three dimensions:

- Importance of each criterion – which are most critical

- Performance of your product/brand on each criterion

- Performance of competitors’ product/brand on each criterion

Collect this data from customers and prospects. Customers know the most about your brand and solutions. They can speak to your strengths and weaknesses in ways that prospects cannot. However, they may not represent the needs and perceptions of prospects. Prospect feedback ensures that you identify opportunities and hurdles outside the current customer base. They are also the best source of information about competitor performance.

The feedback can be collected using quantitative tools (surveys) or qualitative approaches (in-depth interviews). Sometimes it makes sense to use both. Assigning importance to criteria can be done using basic ratings, multivariate analysis, or ranking tasks such as Max-Diff. Regardless of the approach you use, try to collect the data in an objective and systematic way.

3. Analysis & Mapping

Knowing both the importance of a criterion, and how competing products perform on it, yields a visual map of the competitive landscape.

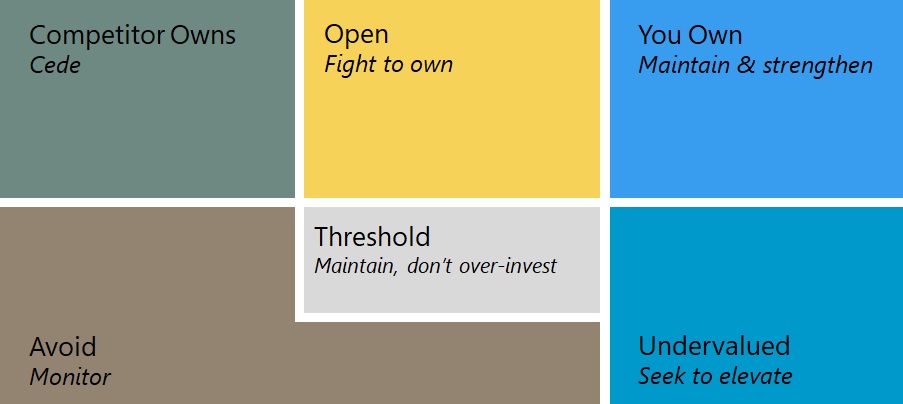

The value of the map is in the interpretation and identification of an actionable differentiation strategy. Based on each buying criterion’s position on the map, it is classified as:

- You own-Maintain and strengthen: Important buying criteria where you have an advantage over competitors. They can be used in branding, sales, and marketing communication to make you stand out from competitors.

- Competitor owns-Cede: These are important buying criteria where competitors have an advantage over you. Trying to displace competitors from these positions will require significant resources and, at best, end up at a parity condition.

- Open-Fight to won: These are criteria that are important to the marketplace that are not being met by any vendor. They represent opportunities for developing your solution to lead the market in meeting these needs.

- Undervalued-Seek to elevate: These are strengths that you have over competitors that the market doesn’t view as important as other criteria. They represent opportunities to educate the market.

- Thresholds-Maintain, don’t over invest: These are criteria that all vendors must be to be in the consideration set but are not competitively differentiating.

- Avoid-Monitor: These are areas that are undervalued by the market and you do not possess any meaningful advantage.

This analysis and visualization can be especially useful for companies that are in transition from an inside-out, product-focused orientation to a more outside-in market focus. The framework provides a means of establishing a mutual understanding among internal stakeholders (e.g. marketing, sales force, engineering, and customer service) of your competitive differentiation.

Value of a Systematic Approach

Even without collecting customer or prospects feedback, the framework provides a systematic process for you and your stakeholders to conceptualize your relative competitive differentiation. Product marketers and managers can follow this process using internal resources, experience and judgement to identify and place possible your competitive differentiation.

As a strategic research consultant, Isurus supports clients with services ranging from guidance and practical advice to more formal, full-service research engagement. Get in touch to explore how we can help you.

Click here for more information on how we help clients understand buyers and markets.