Know your B2B buyer

Six dimensions for a strong B2B buyer understanding

In any part of the economic cycle, organizations that understand their customers and prospects achieve better results, whether measured by growth, profitability, or other metrics. The current pandemic recession highlights how quickly B2B buyer needs can evolve, and the need to ground decisions in accurate data.

When to update your buyer understanding: Signals to watch

Organizations get feedback from their customers on a routine basis. Sales reps and customer experience staff interact with customers regularly. The company may have a Customer Advisory Board and user groups. This ongoing contact can generate confidence that buyer needs and motivations are well understood. However, stay attuned to signals that there is an incomplete understanding of the buyer. Examples include:

- Customers churn or prospects do not convert, and Marketing and Sales don’t understand why

- New products or enhancements fall short of revenue projections

- “The buyer” is defined as an organization more so than individual roles/functions that buy or use the product

- Competitors are first-to-market with innovations and enhancements

- Revenue growth is plateauing when competitors continue to grow

- The volume of new leads has slowed

- Buyers want information or experiences that don’t fit the current sales process

In a period of economic upheaval, it becomes more important to monitor business and buyer trends for signals. Looking ahead, B2B buyer motivations and behaviors will change in response to the pandemic and recovery. The specifics will vary by product and sector. Marketers with a strategic view will act to assess their understanding of buyer needs.

Checklist to build B2B buyer understanding

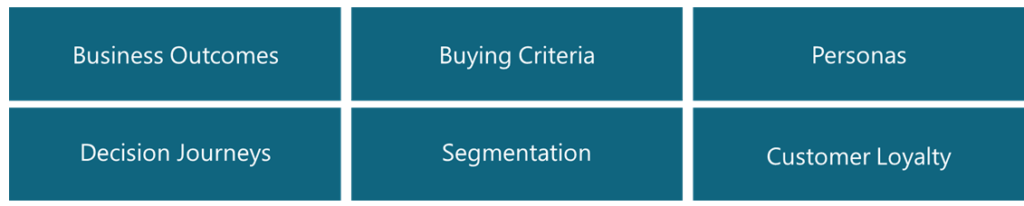

With that goal in mind, use these six categories of insights for outside-in assessments and stay aligned to changing buyer needs.

Business Outcomes

B2B buyers invest in solutions to achieve a business outcome. Understanding the desired outcomes and jobs-to-be-done helps prioritize features/functionality for investment and for marketing/sales messages. It also identifies direct and indirect competitors to reveal why the market uses the solutions it does. The pandemic and recovery will change priorities for investment. There will be new jobs-to-be-done. For example, needs related to automation, digital transformation, supply chain resilience, and flexible staffing will increase in importance, along with health and safety priorities.

Buying Criteria

Measuring the relative importance of features and price is the first step to understanding how the market compares vendors and solutions. Often overlooked buying criteria include fit with existing processes, connections to ecosystems, and brand perceptions. These non-product related criteria can be the deciding factor when prospects believe multiple products and vendors could meet their needs. The next months/years may bring greater price sensitivity, preference for stable vendors with a proven track record, or more interest in features that support business continuity. Social responsibility is also coming to the forefront given the public health, environmental, and social justice challenges facing society.

Personas

Rich profiles of buyers and users are especially helpful to marketers in B2B sectors, where collaborative decision processes are the norm. Personas articulate the needs of different stakeholders in the buying process. They provide the foundation for value propositions and campaigns. At a fundamental level, personas reinforce that regardless of the product or service, human beings with needs, perceptions, and emotions make the purchase decision. The pandemic shutdown is impacting physical and emotional well-being. B2B buyers may gravitate to brands that evoke control and certainty, rather than excitement or complexity.

Decision Journeys

Many B2B purchases involve multiple decision makers and have long sales cycles. By understanding the process steps, who is involved, and when, the sales and marketing team can provide the right level of information, to the right individuals, at the right time. The number and nature of the triggers that prompt prospects to investigate new solutions narrows during economic downturns. Buyers will require more insight into pricing at an early stage of the sales funnel. The purchase timeframe may lengthen.

Market Segmentation

For most B2B vendors, specific segments of the market offer more opportunities than others. Segmentation analysis identifies groups within the market that share needs, perceptions, willingness to spend, etc. This market knowledge enables B2B providers to target their marketing and sales efforts towards the market segments with the most opportunities. The recession may reshuffle the segmentation as new segments emerge and others shift in priority.

Customer Loyalty

The strength of the customer relationship, whether measured by Net Promoter (NPS) or other metrics, acts a barometer for the broader market. Regular assessment of customer satisfaction and loyalty KPIs enables B2B vendors to track shifts over time. When scores dip or rise, it’s time for deeper analysis to identify underlying drivers. As buyer needs and motivations change in this recession, customer metrics are likely to fluctuate as well.

Creating a plan

To understand buyers, build a plan for:

- Developing data sources

- Identifying insights in the data

- Applying the insights for strategy and go-to-market execution.

Developing data sources

Combining data from multiple sources provides the most complete understanding of the buyer. Data sources to utilize include:

- Formal market research studies that provide a robust and representative view of buyers. These studies may be quantitative or qualitative in nature.

- Win/loss data

- Customer visits and interviews

- Customer Advisory Board

- Sales data, captured in SFA systems and gained through debriefs with Sales colleagues

- Ongoing customer surveys, such as NPS

- Market scanning and listening, for example, via online reviews or social channels

- Competitive intelligence on customer acquisitions, earnings announcements, product announcements

Analyzing data and applying the results

To inform decisions, buyer data should be captured and reviewed systematically. Without an analysis plan, decisions can be biased by the compelling interview that comes easily to mind or the most recent anecdote shared by Sales.

The analysis process is often overlooked and its importance underestimated. Whether using internal or external data streams, make sure there’s a plan and systems in place.

Frequency for updating buyer understanding analysis

Staying current with buyer shifts creates resilience and competitive advantage. The recession will change the pace at which organizations need to assess their understanding of buyers. Most organizations should increase the frequency with which they listen to buyers and assess implications for the business.

Understanding buyers is a foundation for success in any economic scenario. Maintaining or strengthening these insights will enable organizations to recover more quickly and adapt to take advantage of new opportunities.