Competitor Sorting: Ignore, Monitor, or Threat

Competitive intelligence delivers both short-term and long-term benefits by helping Sales close more deals, informing product messaging, and as an input to the product roadmap. Product marketing, product management, and the sales team are hungry for competitive intelligence. They want to know how the market views competitors, how offers compare, which competitors to pay attention to, which ones to ignore and why prospects select one vendor over another.

Many B2B vendors operate in fragmented markets that include dozens of competitors. This is especially true in B2B software where the cloud has decreased switching costs and given rise to competitors that focus on a narrow set of segments or functionality. Product marketers and managers tasked with keeping tabs on competitors and identifying competitive threats can feel overwhelmed or not know where to start. B2B marketers only have so much time and resources available to investigate competitors. And some of that time is taken up responding to urgent requests from sales to investigate competitors that were in a recent lost deal – even if it seems the vendor’s inclusion was an anomaly.

B2B marketers need a simple, yet systematic, process to identify which competitors warrant ongoing focus and attention.

Many of Isurus’ B2B clients split their competitive intelligence activities into two categories:

- High-Level Market Scanning

- Competitor Profiling

Competitive Market Scanning

The goal of a high-level market scan is to efficiently filter and sort lots of potential competitors to identify the subset that warrant a deeper analysis. The starting point is typically creating a list of all the competitors the product marketing team is familiar with and the vendors that the sales team reports encountering. Data is sourced primarily from desk research of publicly available information.

Elements typically explored include:

- Solutions. What is the competitor’s primary solution? How much overlap is there with your solutions? In the areas where you compete is product/service a primary offering for the competitor?

- Size. How many clients do they have? How many employees do they have? What’s their annual revenue?

- Growth. Has the number of employees increased over the past few years. Has the company added a key sales executive? Has it received a newfound of funding or brought on new investors?

- Segments Served. What segments does the vendor focus on? How much overlap is there with your segments?

- Differentiation. How does the competitor talk about their differentiation. Do they talk about their experience, technology, focus on a niche sector, cost, etc.?

- Price (scope of magnitude). How much does the competitor charge? Depending on category pricing can be the most difficult data point to find and often not available.

- Reputation. How well known is the brand? How does the firm rank in analyst coverage or online reviews? What are employees saying about it on Glassdoor?

The above information can be found in competitor websites, social media, job postings, press releases, and online reviews. The aggregated information is then used to triage vendors based on their level of competitive threat. Isurus recommends sorting competitors into three categories: Ignore for Now, Monitor, and Competitive Threats.

- Ignore for Now: While all competitors represent a threat to some degree, some can be safely ignored for the time being. They may be so small that your firm is unlikely to encounter them in many deals. Or their primary focus is on a different sector and their recent reach into yours was opportunistic. Whatever puts them in this category, the outcome is the same: If you have limited resources, it does not make sense to use those resources figuring out how to compete against these firms.

- Monitor: Some competitors will not warrant deeper analysis immediately, but you should continue to monitor them. Plan to check-in on them at a sensible cadence – monthly or quarterly depending on the dynamics in your space. Automated Google alerts are helpful tools for passive monitoring. As you monitor, watch for signs of change in how they approach the market, whether they are gearing up their sales organization, increased presence at industry events, and the like.

- Competitive Threats: The third and most important group are the clear competitive threats based on their size, focus, product capabilities, and how often Sales encounters them in deals. These represent the most important competitors to understand and where you should focus any additional time or resources.

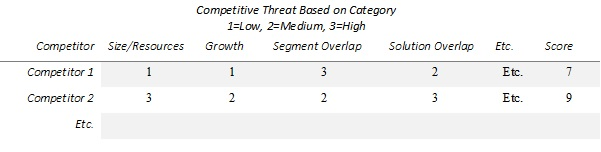

Scoring competitors on a matrix helps to evaluate and categorize each firm. For example:

Competitor Profiling

Once you have identified your most critical competitive threats, a thorough profiling may be warranted. The profiling process can include additional secondary research, internal primary research, and external primary research.

Deeper Desk Research & Proprietary Resources

One path forward is to build on the desk research conducted in the market scanning phase by spending additional time digging into industry publications and trade associations, looking for contracts and financial announcements, and investing in financial databases and analyst reports.

Mining Internal Knowledge

Often companies have competitive intelligence scattered across their organization. Product marketers and product managers can conduct research with internal stakeholders and consolidate those insights. This includes research with:

- Sales. Interview or survey the sales team to find out how often they encounter the competitor. What is the nature of those deals? How big is the prospect? What segments do they see them most often in? If you have a good CRM/SFA you may be able to pull the information from the system.

- Engineering / Product Management. Interview or survey the engineering and/or product management teams. These teams likely keep their own tabs on competitors.

- Ex-Competitor Employees. People often stay within the same sector when they switch jobs. Look to see if there are any employees at your company that worked at the competitor. Or perhaps in your social network. If so, interview them.

While the perceptions of internal stakeholders are colored by the lens in which these individuals view the world, they can still provide useful information on competitor strengths and weaknesses.

External Primary Research

Some competitors may represent a significant enough threat to make it worth investing time and resources in conducting external research to better understand their strengths and weakness relative to your company and solution. That research can include:

- Win / Loss Interviews: Interview recent wins or losses where the competitor was in the deal to explore the competitor’s strengths and weakness, why the prospect made the decision they did, etc. There are many win/loss templates available online. The Product Marketing Alliance makes an effective one available to members.

- Competitor Customer Interviews: Some vendors highlight customers on their website in testimonials or case studies. Try to conduct interviews with some of those customers. Featured customers are typically very satisfied and do not reveal competitor weaknesses, but these interviews do provide insight on competitor strengths.

These external research activities can be designed, executed, and analyzed using internal resources. That said, they require a commitment of time and effort, and can benefit from external expertise, which is why many firms collaborate with a trusted partner on these activities.

Focus on the Competitors that Matter

While B2B marketers must understand the full range of competitors they face, they should focus their time and energy on the competitors that represent their most significant competitive threats. Conducting a high-level market scanning exercise followed by in-depth competitor profiles where warranted helps accomplish this objective.

If you’d like more information about how Isurus can help with competitive intelligence reseach out to us here. Another good source of information is the Society of Competitive Intelligence Pros.