Strategic Competitive Analysis: Techniques for Product Marketing Success

The need for competitive analysis can surface suddenly when a new competitor enters the market, or an existing one appears more frequently in competitive deals. It can also be part of a more strategic evaluation of your competitive environment with the goal of developing battle cards and informing product messaging and roadmaps. In either case, the B2B marketers tasked with providing these insights need a reliable and consistent way to analyze the competition.

In any approach, from DIY to Competitive Intelligence platforms, a significant amount of information is publicly available from online sources. The key to a valuable competitive analysis is turning the information into useful intelligence for the business. This article outlines a framework for organizing the information and a model for ranking competitive threats.

This post provides two useful approaches for competitive analysis.

- The first approach is a framework that outlines the dimensions Isurus recommends exploring and offers some suggestions for where to find the information.

- The second is a model for objectively ranking competitors by the threat they represent. This helps ensure you focus your product, marketing, and sales energies on the right competitors.

The framework and ranking method are based on Isurus’ 20+ years of competitive analysis and market research in B2B markets.

The Competitive Intelligence Framework

Using a framework provides two benefits.

- It ensures that you collect enough categories of information to make an objective assessment of the competitor.

- It enables you to systematically compare competitors on a set of key dimensions.

The framework identifies five categories of insights for competitive analysis research:

- Size and Growth: What is the competitor’s revenue? How many employees do they have? How much funding have they received? Are there indications that it is growing or positioning itself for growth? Key data elements include revenue, funding, number of employees, and strategic changes such as new management, acquisitions, new funding announcements, and hiring surges.

- Market Focus: What is the competitor’s primary solution? What segments do they focus on? How much overlap is there with your solutions and segments?

- Differentiation: How does the competitor present its differentiation? Do they talk about their experience, technology, focus on a niche sector, resources, cost, etc.? How well-known is the brand? What is their brand reputation? How does the firm rank in analyst coverage?

- Features / Depth of Solution: How do the competitor’s features and functionality compare with yours? What is its core feature set?

- Pricing: How much does the competitor charge? What pricing model do they use?

Sources of Information

As noted previously, the bulk of competitive insights data comes from publicly available sources. The amount of information available will vary by competitor. Larger competitors typically have more information available than smaller companies. The amount of information available in each category also varies. For example, pricing for enterprise-level products is typically difficult to source.

Examples of the sources of information we recommend turning to include competitor websites, comparison sites, analyst reports and market guides, online reviews, LinkedIn profiles, investor databases, and industry associations.

Stats… But Not the Whole Story

Your research will give you stats and insights about competitors, but not the whole story. Some of the data you collect will be inconsistent, especially for private companies. For example, one source will list revenue at $40M, and another will say it is $150M. In addition, strategic changes can be ambiguous. Does the new SVP of Sales’ previous time at Salesforce provide an advantage? Is it a neutral? Does it represent a potential change you can position against. In some ways, the data in a competitive analysis report is analogous to a scouting report on a draft prospect for a professional sports team. They provide indicators of strengths and weaknesses. You need to layer your experience and judgment over all the stats and trends and decide what it means for your company.

To round out your conclusions, incorporate the competitive insights that are likely scattered across your organization. For example, you can ask Sales how often they encounter the competitor? What is the nature of those deals? What segments do they see them most often in? You can see if there is anyone in your company who used to work for a competitor – people often stay in the same sector, and sometimes category, when they switch jobs. The one caveat with these internal sources is that their perceptions are colored by the lens through which they view the world.

Ranking Competitors: Competitive Market Scanning

Competitive analysis often results in an abundance of firms that are, to varying degrees, competitors. While each competitor is a potential threat, monitoring them all can overwhelm B2B marketers who only have so much time and resources available. And some potential competitors may be too many concentric circles away from your core business to waste time worrying about. The challenge becomes to identify the subset of firms that are meaningful competitive threats and should be the focus of your product, marketing, and sales energies. These are also the competitors that warrant ongoing monitoring to quickly identify and respond to new developments.

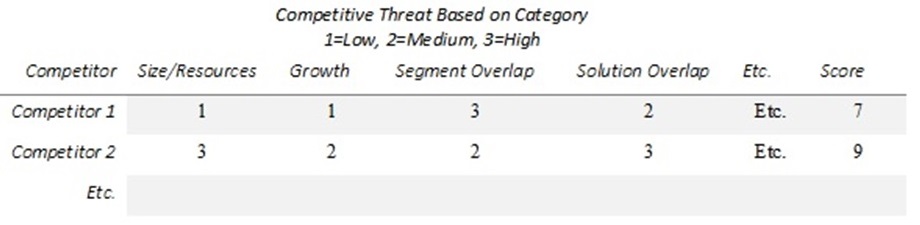

Isurus recommends using a simple model to sort competitors into three categories: Ignore for Now, Monitor, and Competitive Threats. Use a simple scale to rate each competitor on the key competitive dimensions from the competitive analysis framework: Size, growth, segment/solution overlap, etc. Once you’ve rated all the competitors on all the dimensions, sum their ratings to get an overall score. A higher score equals a greater competitive threat.

This approach is based on the behavioral economics principles pioneered by Daniel Kahneman. Systematic simplicity enhances objectivity.

Once all competitors are scored, sort them into three categories.

- Competitive Threats: These competitors are clear threats based on their size, focus, product capabilities, and encounters in competitive situations. These are the competitors worth spending additional resources to learn more about and to monitor on an ongoing basis.

- Monitor: These competitors do not warrant deeper analysis immediately. But plan to check in on them at a sensible cadence based on the dynamics in your space.

- Ignore for Now: You can safely ignore these competitors for the time being. Whatever puts them in this category, the outcome is the same: If you have limited resources, it does not make sense to use those resources to figure out how to compete against these firms.

Double-clicking on competitive threats with win/loss interviews

Some competitors represent a significant enough threat to invest in primary market research to better understand their strengths and weaknesses. The most common source for primary data is to conduct Win/loss Interviews with opportunities where the competitor was evaluated. There are many win/loss templates available online. The Product Marketing Alliance makes an effective template available to members.

External Expertise & Assistance

All of the activities outlined in this post can be designed, executed, and analyzed internally. However, they require a commitment of time and effort. And often, competitive analysis benefits from external expertise. For more information about Isurus’ competitive intelligence research, contact us here. The Strategic Consortium of Intelligence Professionals is another good resource for information, templates, and best practices.